Category Archives: Offer and Compromise (OIC)

Have you heard of an FTB offer in compromise? It’s rare, but it can happen in certain cases. Read on to learn more about how you can potentially get California tax debt forgiveness, and what some of the requirements are to qualify.

Read More

The IRS is a powerful debt collector, to say the least. They have the entire mechanism of the government’s resources at their disposal, and they will utilize it to ensure that they are able to collect unpaid taxes. Although the IRS is incredibly aggressive, the system is inherently fair, because there are plenty of potential […]

Read More

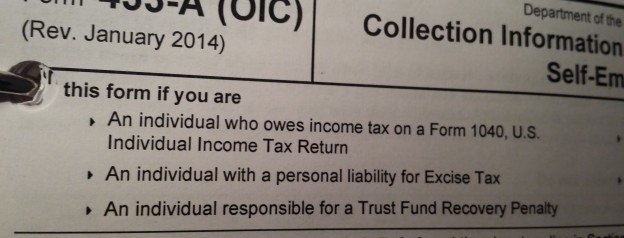

How does an offer in compromise work? What guidelines are necessary to take advantage of it, and when should a tax attorney be retained to help with the process?

Read More

Offer In Compromise TIP – Equity in income producing assets will generally not be included in the reasonable collection potential of a viable, ongoing business. We see many offer in compromise analyses that mistakenly include the equity in business assets and thus, taxpayers may end up paying a much higher offer amount or worse, not […]

Read More

Grammy Award winning R&B star, R Kelly, 44, is another name just added to the roster of celebrities who have failed to pay their income taxes, joining the likes of Dennis Rodman and most recently Lauryn Hill. Kelly reportedly owes more than $4.8 million in taxes dating back to 2005. According to MTV, the breakdown […]

Read More

Big news from the Offer and Compromise (OIC) front. On May 21, the IRS announced more flexible terms to help a greater number of struggling taxpayers make a “Fresh Start” with their tax liabilities. This phase of Fresh Start will assist some taxpayers who have faced the most financial hardship in recent years, said IRS […]

Read More