All posts by Abajian Law

At Abajian Law, we’ve put together an action plan if you find yourself with an IRS tax bill that you’re unable to pay.

Read More

Many people are surprised to find out that there are people out there who pose as the IRS and contact you with the intent to defraud you.

Read More

Vic Abajian, Esq., LL.M. of Abajian Law was invited to speak at the Armenian Bar Association’s Soiree held at the Beverly Hilton on Saturday August 20, 2016.

Read More

Many people who owe money to the IRS have heard about tax resolution, but don’t know exactly what it is or how to get it. If you’re considering tax resolution, here’s what you need to know.

Read More

The IRS has established a special procedure for people whose assets were forfeited in relation with structuring to request a return of their forfeited property or funds.

Read More

The massive leak dubbed as the “Panama Papers” in the media has brought attention to the ability of high ranking world leaders, the rich and the elite to use foreign bank account and nominee entities to hide their wealth. Passports of at least 200 Americans show up in this week’s massive leak of secret data […]

Read More

Although experienced practitioners knew the IRS position, it was formally …

Read More

Vic Abajian appeared as a panelist and speaker at the 2015 California Tax Practitioners’ Conference presented by the Los Angeles County Bar Association’s Taxation Section. The conference regularly attracts California’s most powerful and respected tax professionals for a day of continuing educational seminars and interactive dialogue about the latest trending tax topics in the taxation […]

Read More

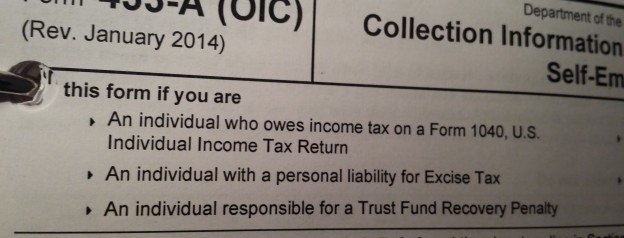

Offer In Compromise TIP – Equity in income producing assets will generally not be included in the reasonable collection potential of a viable, ongoing business. We see many offer in compromise analyses that mistakenly include the equity in business assets and thus, taxpayers may end up paying a much higher offer amount or worse, not […]

Read More

The 5% penalty Streamlined Filing Procedures for undisclosed foreign bank accounts and assets was modified and is now available for domestic taxpayers with foreign accounts. It’s available only to taxpayers who’s failure to file an FBAR was due to non-willful conduct. For willful conduct, a taxpayer would be better advised to join the OVDP whichThe […]

Read More